5 Important Compensation Facts

Introduction

Show me the money!

A few days ago, someone pointed out that I have "Top Linkedin Voice in Compensation and Salary Negotiation" and well, I decided to do the responsibilities given to me by such a prestigious honor and help you earn more by explaining how this works.

In all seriousness, understanding Compensation is critical and we do an absolutely horrific job of explaining it. The only reason I am so well versed in this is simple exposure as one of the very few roles in an organization that has the access that I do. The level of authority I have in approving salaries and managing compensation annual cycles with executives.

This is why I push so much content to try to inform and educate so that everyone has access to this.

The Disconnect

One of the largest reasons that there is so much misinformation on this, in addition to the lack of transparency, is that there is a fundamental gap between perspectives. For us as employees, money is one of the most critical resources we have. It's how we live, it's how we eat, it's how we save and plan and try to find moments of enjoyment. If we have it, we are worried and want more "just in case". If we don't have it, we worry, we stress, we go hungry, we lose houses.

To companies and organizations, your salary is a business cost, and it has to be justified against the perceived value that you can offer in that role.

To help cover that gap, here are 5 facts about Compensation that you may not know.

Disclaimer - All of my experience is in "Corporate America" so these conclusions ONLY reflect that experience. I have no idea of the validity of these in other arenas such as Government, Medicine, Education, Legal, etc

Fact 1: It's a Brilliantly Devious System

What many people do not know is that the system in which organizations determine Compensation is based on a brilliantly evil methodology that is long overdue for an overhaul.

Companies can use any titling system they want, but in order for companies to anonymously receive information about what similar companies may be paying to similar roles, third party companies came into being to establish a universal levelling system.

Organizations like Aon-Radford, Towers Watson and Culpepper became some of the international giants of market data for job pricing.

As part of their formula and structure, there is a universal job leveling system that companies adhere to for this pricing. Meaning even if your company calls you a "Vice President" it could be that you are externally benchmarked to "Manager" based on a careful system of competencies, metrics, qualifications and scope.

Now the part that is brilliantly evil is that unlike Glassdoor or other public sources of data, the information these companies have is fantastic because it is AUDITED, not Self-Reported. Which means the level, reach and sheer amount of information that can be accessed is incredible.

However, you can ONLY purchase these licenses if you are a COMPANY.

And - you can only access it, if you also GIVE your Compensation information.

This means organizations have incredible amounts of information at their fingertips as they determine and gauge their compensation strategies.

Fact 2: There is a Science to This

Due to the lack of transparency, it is very common and natural for employees to feel like everything about Compensation is behind a black box. Why does the company "have no budget for raises" when you just asked for one, but then your co-worker gave notice and she told you that got a 20% counter-offer to stay.

Why did you receive a fantastic offer at $85,000 but learned the new employee is making $90,000?

The truth is, though not always perfect, the goal of Compensation is consistency.

As the generation turned in the early 2000s, we started seeing a monumental shift of how compensation was thought of as "The War for Talent" began and organizations realized that employees needed to feel well paid for their efforts and that investing in these strategies would yield much better results.

This is where we began to see the sunset of harmful compensation incentives such as managers receiving bonuses for under-hiring and the introduction of compensation philosophies.

This meant an increase in Compensation professionals, and data-informed strategies. This could mean anything from determining that a specific skill set was more valuable and thus deciding to place higher value on certain roles or job families, building out a tiered compensation plan that favored additional compensation offerings for revenue impacting roles, or that the company only reviews salaries once per year.

When you ask for a raise, and it's right after the annual cycle - there is no budget, inclination or strong business reason to re-review it. If the organization were to do it, it would then have to answer "what if everyone asked?" and unless there is a very strong reason to, it doesn't want to put itself at risk.

Though you have more tenure, it's very possible, if not likely that new employees do earn more than you - this is a common market condition and provided that you are all paid within a target range, the organization is satisfying it's desire to be consistent.

Though neither of these "feel good" - and can feel maddening and frustrating, there is almost always a scientific methodology behind these decisions that tries to ensure a fair and consistent approach to all employees (even though it's not as generous as they should be.)

Fact 3: Most Compensation Advice isn't Informed

Whether or not it's scam artists masquerading as "Salary Negotiation Coaches" who literally just take a cut of your new offer while doing absolutely nothing but providing you with a ChatGPT template, or well meaning professionals who think they have it figured out, the truth is most of the conclusions and advice surrounding Compensation is at best, harmlessly incorrect and at worst, detrimental to your financial situation if you follow it.

For example, whenever I make content about salary negotiations and people disagree and say "whoever gives the first number loses" - are citing well known negotiation experts.

This is accurate - but for transactional negotiations.

If I want to buy a house, I want it as cheap as possible, the other party wants it as expensive as possible. We are at odds aside from the fact that I want to buy what they want to sell.

Employment offers are NOT like this.

(Not all, but many) Employers do want you to feel excited about your offer. When recruiters, managers or myself get involved in a new offer, promotion or raise, it actually feels quite wonderful if it's more than you hoped.

While it goes against logic and reason, employers do not want to save money on your salary. Headcount is the most expensive cost an organization has and the full "budget" for your role is far more than just your salary. If the organization has decided it needs your role, it's not looking to save a few thousand bucks by lowballing you.

As a point of fact, most organizations want everyone within a similar job family and level to be within a relatively small target range of each other.

This means that if most employees within a group earn $85,000 - $105,000 and you as a new candidate mention to your recruiter that you are looking for "70,000" the company isn't going to offer you that because it has just introduced a risk in inequity. Your offer will be between $85,000 - $95,000 based on how you interviewed and how your skills and competencies compare against the team.

Additionally in new offer negotiation, a common phrase is "Always Negotiate" or "Everything is Negotiable" - both of these are false.

I agree with the concept of "Always INQUIRE" - but if you have a company who has told you they do not negotiate, or if you are a fresh graduate with zero experience to negotiate with, you put yourself at potential risk of an offer being pulled.

Using language such as "I can't accept lower than x" gives the organization a golden opportunity to pull your offer, especially if they have already informed you that they don't negotiate and have clearly explained that the top of the range is $20,000 below what you are indicating in the phone screen.

However, asking questions, especially clarifying questions, can lead to either information, or a more beneficial negotiation experience and offer.

Finally - everything is not negotiable. (Though everything is up for DISCUSSION)

Some people indicate that you should try to negotiate for perks such as a fully remote role, utility payments or a cash payout instead of health benefits.

While small organizations may be more open, most companies will find it very concerning if a role has been advertised as in-office or hybrid and at offer you are now requesting something else.

Additionally, any company that offers ERISA compliant health or wealth benefits can not negotiate elements like health care or 401k offerings as it's part of their plan document that every employee has access.

Fact 4: FIRE is Real and the old adage isn't accurate

For those unfamiliar, FIRE stands for Financial Independence, Retire Early—a movement gaining traction for its emphasis on achieving financial freedom and retiring well ahead of the traditional retirement age. It's a philosophy that encourages strategic savings, investments, and mindful spending to escape the rat race and early and enjoy life knowing you'll have all the resources you need to do so.

But how does this compare to the age-old adage: "You will never be rich working for someone else."

While this saying holds a grain of truth, especially in the context of entrepreneurship and the potential for unlimited wealth creation, it's essential to recognize that corporate America, too, offers ample opportunities for a very comfortable living.

In today's corporate landscape, we see that significant financial achievements are exclusive to business owners or entrepreneurs. Many individuals have navigated the corporate hierarchy strategically, leveraging their skills, dedication, and, crucially, understanding of financial principles to attain financial independence and a lifestyle that aligns with their goals. I myself have signed off multi-million dollar offers at Director level and above and by leveraging knowledge of corporate America, have helped myself and others do the same.

Corporate careers can provide stable income streams, comprehensive benefits, and opportunities for advancement that contribute to a comfortable and secure financial future. Climbing the corporate ladder isn't just about working for someone else; it's about strategically positioning oneself within an organization that values talent, and then taking those skills and experience and ensuring you are being paid a premium for it, either at your current organization or the next one.

One of the most important elements to FIRE and financial security within these roles is moving away from organizations and job roles and families that pay in just salary, and instead move to mixed-model companies that employe additional cash incentives such as bonuses, commissions or equity participation.

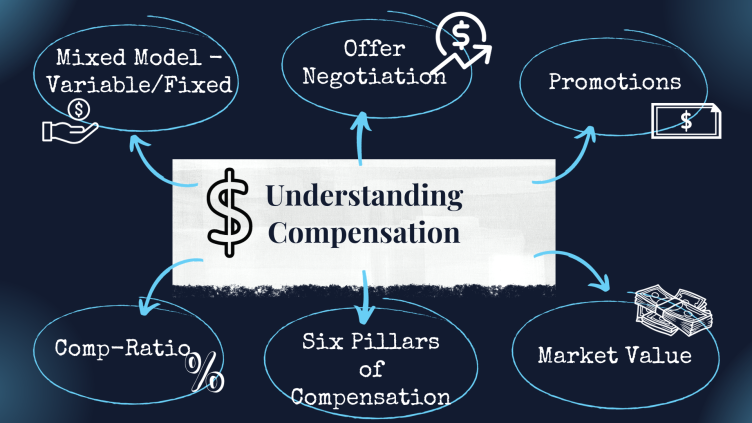

Fact 5: There are SIX distinct Elements

Understanding not only how companies think about compensation, but the different elements that IMPACT compensation is one of the strongest tools in your toolbelt for achieving financial security if not wealth while working for an organization.

Most people know two of them as they are quite common - the first being job level.

Generally speaking, the higher your level, the more responsibility you have and thus the more value you bring to an organization. Many companies that use additional methods of compensation also tend to add higher targets for higher levels. For example a mid-level individual contributor may be entitled to a 5% bonus and $10,000 worth of stock but a principal individual contributor may be eligible for 15% bonus and $25,000 worth of stock.

Another common factor is location. Due to local costs of living and local costs of labor, you are always going to see higher compensation values the closer you are to a large metropolitan city.

COVID-19 and the global pandemic introduced new variables as remote work became universally embraced, but while we saw some shifts in natural averages, the data still confirms that NYC and San Francisco still have the highest paying salaries on average.

Other elements aren't quite so well known and don't always work.

For example, another element is job family. Typically job families that are closest to either revenue generation or protection see higher compensation. This is especially seen in roles like Sales, Technology, Data and Product.

Roles that are more operational in nature tend to be valued a little lower which is why we see a dip in Program Managers, Leave Specialists, Account Payable Representatives and Facility Managers. (It's important to note, I am talking about ROLE, not people)

Other elements are industry, company revenue/profit and size. Typically speaking larger companies in impactful industries such as Technology, CPG, Insurance and Pharma have really good compensation philosophies and usually pay quite well compared to other industries. There are always exceptions though as industries such as Music, Entertainment and Sports, while very lucrative and generate a ton of cash, do not reward the employees as most of that money goes to the talent.

Finally one of the most intriguing elements is job family <> industry alignment.

You want to work for a company in an industry that places a high value on that job family/role. As an example, software engineers and technologists can earn a great deal of money working at a FAANG or large tech company, because of how valuable that skillset is to that industry. In contrast, working in Marketing for these exact same companies may lead to a decent salary and compensation package, but nowhere close to their technological peers.

However, go to Pharmaceutical and you can often see a complete reversal - in which Marketing, Brand, Communication and Product Marketing are very well compensated, while technological employees are paid closer to an average market.

In Conclusion

Money is important and it is not talking about enough and it is okay to indicate this as a motivation. Companies do a terrible job of training and coaching managers how to have these conversations with employees in a safe, productive manner and as we continue to see transparency becoming the norm, it is my sincere hope that this begins to change.

Get your bag!

~Dan

I recently published a guide on Compensation that clearly explains all of how this works, why things are the way they are and most importantly, how to optimize for your own financial health! Check my website for more information and don't forget to review the "automatic discount" section in addition to the "Resources" page to access all of my free content as well.

Additionally, I consistently post Compensation content on Linkedin and on my Tiktok Profile

- Choosing a selection results in a full page refresh.